Vacation home mortgage qualification calculator

Our vacation home mortgage program involves a qualification process that assesses your holistic financial profile without paperwork-related roadblocks and red tape. For private mortgages you may be able to borrow up to 95 of your homes value.

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

For example lets say.

. Our second home mortgage calculator uses a maximum debt-to-income ratio of 43 overall which is the maximum amount that many lenders will accept. Fannie Mae allows a DTI up to 45 with a. How it Works.

In 2021 vacation and second home demand surged 84 higher than in 2020. A vacation home of your own can be a great way to unplug and unwind. Type Interest Rate Points APR Monthly Payment1000.

Debt-to-income ratio requirements depend on the size of your down payment and your credit score. 5 of first 500000 10 for any amount above that. Many factors affect what size mortgage.

Vacation Home Mortgages- Seasonal Fixed. The following table shows the calculation methods for figuring out the highest payment you could qualify for based on credit rating. All loans priced individually.

Seal the deal and enjoy. Our second home mortgage calculator uses a maximum debt-to-income ratio of 43 overall which is the maximum amount that many lenders will accept. Medium Credit the lesser of.

With interest rates at an all-time low and many people working from home vacation properties take on a whole. Income required for a second home. Find a great real estate agent.

The maximum size of a HELOC on its own is 65 of your homes value. Evaluate the pros and cons. A Home Away From Home.

It can also be a smart investment if it fits into your planning and is financed properly. Alternatives to buying a vacation home. Based on the table if you have an annual income of 68000 you can purchase a house worth 305193.

5 of home value. Use our Mortgage Qualification Calculator to determine what size mortgage you qualify for based on your monthly gross income and debt expenses. You may qualify for a loan amount of 252720 and your total monthly mortgage.

20 of the homes sale price. Compared to loans for primary residences loans for vacation homes typically have slightly higher interest rates and lenders may require a higher credit score as well as a larger down payment. - The number above is the maximum amount you can spend on a vacation home after factoring in your.

Calculate Your Maximum Vacation Home Purchase Price.

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Vacation Home Mortgage Calculator Vacation Property Online

How Much House Can I Afford Quicken Loans

Second Home Mortgage Calculator Vacation Property Online

Home Affordability Calculator Online Mortgage Calculator Ark Mortgage

Can I Afford A Vacation Home Calculator Vacation Property Online

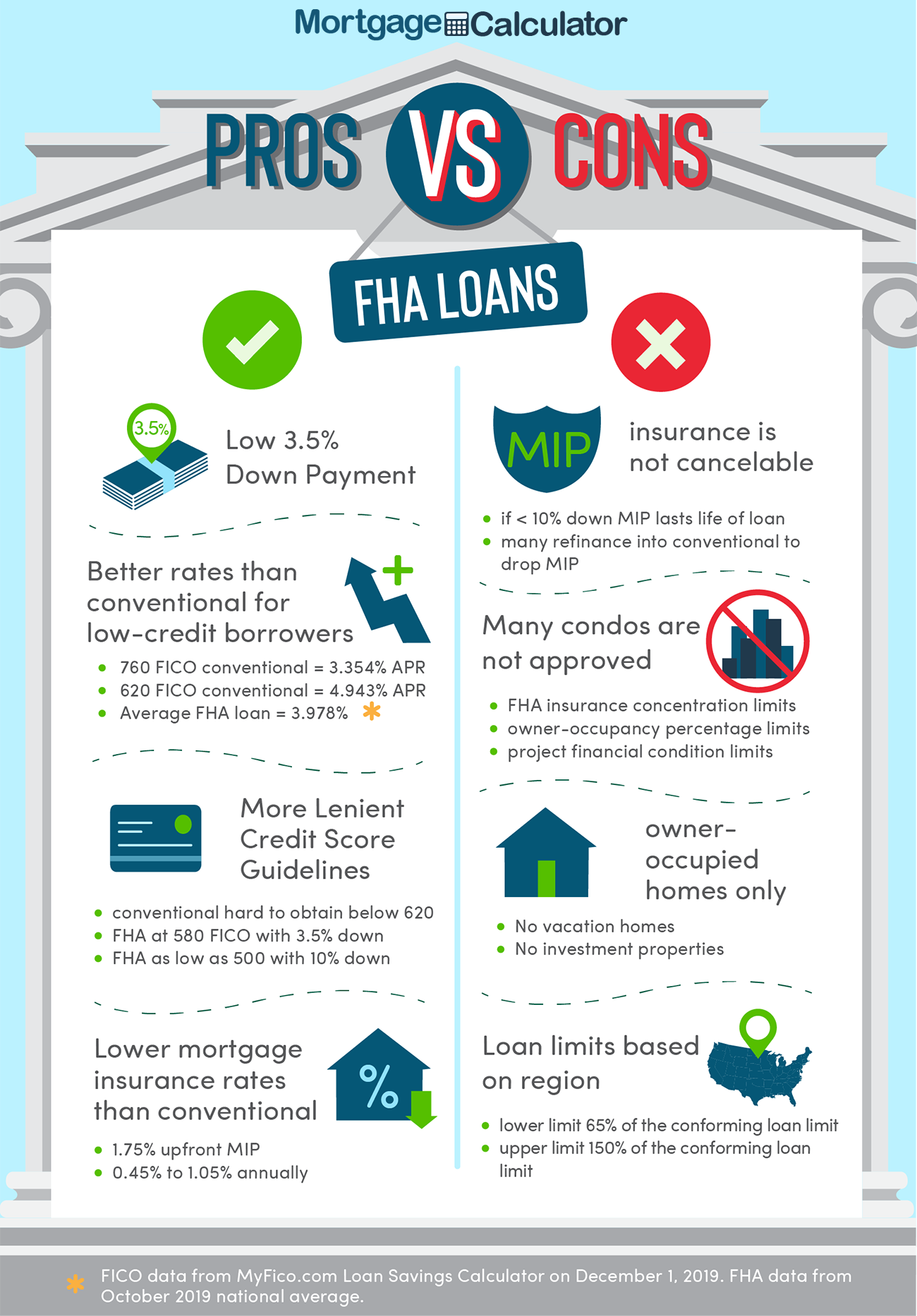

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

How Much Vacation Home Can I Afford Vacation Property Online

When To Count Your Home Equity As Part Of Your Net Worth Sofi

Reverse Mortgage Calculator

Can I Afford A Second Home Calculator Vacation Property Online

How To Get A Mortgage For A Vacation Property Securing Financing For Secondary Properties

Mortgage Calculator Monthly Payments Screen Mortgage Loan Calculator Mortgage Payment Calculator Mortgage Amortization Calculator

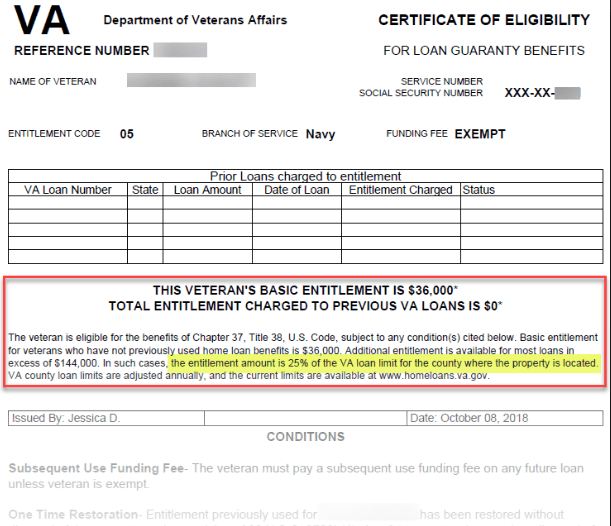

Va Loan For A Second Home How It Works Lendingtree

5 Steps To Buying A Vacation Home Lendingtree

Getting A Mortgage Loan In Mexico Escape Artist

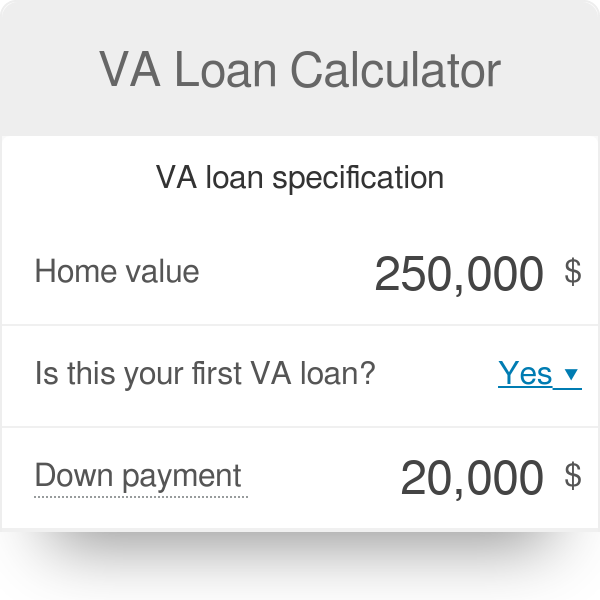

Va Loan Calculator